It’s a new year and it’s time for a new you. A new year ALWAYS feels like a good time to reset, but often only a few people end up really changing. You clicked on this post, so you’ve already taken the first step.

You’ve decided it’s time to get your finances right and live as a responsibly broke person.

You already know New Year’s resolutions don’t start out easy.

Saying them OUT LOUD is usually the moment we convince ourselves that this will finally be the year everything clicks—the year we get ahead, feel secure, and stop stressing about what bothers us the most.

As the new year comes closer, you start to feel hopeful.

You plan.

You dream.

You imagine a life that feels lighter and more in control.

Then you look at your finances. It hits you…

The vision is bigger than the budget. You don’t have enough money to fund your vision.

That realization can feel frustrating, even discouraging. But it doesn’t mean you’re failing, you’re just at a crossroads.

Then you think back and wonder,

Where did all my money go? I need to make more money.

This is where the idea of being responsibly broke comes in.

There’s a difference between being poor and being broke.

When you’re poor, you don’t have enough money to meet your basic needs.

When you’re broke, you can meet your responsibilities but your wants are limited.

None of us will ever strive to be poor, but many of us actually appreciate being broke when done correctly.

Being responsibly broke means you’re broke with intention.

Your bills are paid. Your priorities are clear. Your spending has purpose.

You’re not reckless, you’re not clueless, and you’re not pretending.

In a time when everything costs more and financial pressure feels constant, choosing to live responsibly broke can actually be a form of control.

It’s a decision to stop chasing approval and appearances.

It’s a decision to start building stability.

Whether you’ve been irresponsible with money in the past, are feeling the heat from the inflating prices on everything, or just simply want to feel more secure with what you already earn, I got you covered.

2026 doesn’t have to be the year you magically make more money overnight. It can be the year you learn how to manage what you already have—responsibly, intentionally, and without shame.

Below, I’ll walk you through the first steps to getting your money in order and learning how to live responsibly broke.

This site contains affiliate links, please view our disclaimer policy for more information.

Track Where Your Money ACTUALLY Goes

Everyone has an idea of where their money goes, but very few actually know.

And we’ve seen it before.

People like Caleb Hammer, Ramit Sethi, and Romain Faure are some of the people that make it their job to evaluate other people’s spending habits and call them out when it’s overly frivolous.

Being responsibly broke starts with honesty. Look over your previous spending and track everything.

For it to be effective, the bare minimum in looking back at your previous spending should be the span of 3 months.

Whatever you use to pay for the thing you need or want like debit cards and cards, get all of those statements out.

Look at:

- Groceries

- Gas

- Utilities

- Insurance

- Union Fees

- Loan Payments

- Subscriptions

- Snacks

- Random online purchases

- Convenience spending

- Credit Card Fees

- “Small” expenses

All of those purchases and fees add up faster than you think. Once you see the full picture, you’ll start noticing a pattern within your expenses.

Awareness is the first step to control.

If you don’t know where your money is going, you’ll never know where it should be going.

Learn How to Budget

Now that you’ve seen the pattern of where your money is actually going, it’s time to map out where you want your money to go. This is where budgeting comes in.

For someone who is responsibly broke, a budget is a tool that allows you to spend intentionally and without guilt.

Being responsibly broke means paying your bills now and not worrying about it anymore, while being poor means paying for what you want now and pay what you need later with consequences.

To begin your budgeting journey, my advice is to start simple and make everything visual.

Pick a visual method that works for you. This could be a spreadsheet, planner, or printable budget sheet.

If you don’t want to spend money on a method, that’s fine. You can create your budget on a simple sheet of paper or Google Sheets. You can find inspiration as what to fill your budget sheet with by researching different kinds of planners and budget templates.

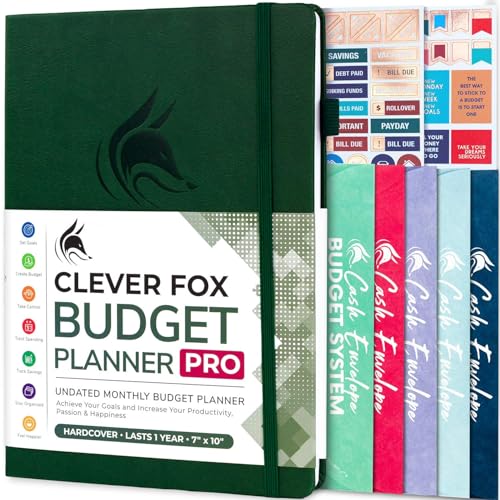

If you want a ready-made option and here is what I recommend:

If you’re the type that just want a printable page, Etsy has many affordable options. Pick one that looks easy and enjoyable to use.

If you just want a planner that is STRICTLY for budgeting, here are a few that I recommend:

|

$5.99

|

$12.99

|

$29.99

|

$22.99

|

$34.99

|

If you want to combine budgeting with meal planning, cleaning schedules, or daily goals, something like The Dailee planners could work.

The Dailee has many different options of “all-in-one” planners. Not only do they make physical planners, but they make spreadsheet planners, notion planners, and ipad planners.

No matter which method you pick, stick with it. Consistency is more important than the tool itself.

After you picked your method, it’s time to really know your numbers.

Start by giving yourself a realistic number for the basics:

- Monthly income – how much money you earn each month

- Fixed expenses – Rent, utilities, insurance, etc.

- Variable expenses – Groceries, gas, transportation, and other essentials.

Once you’re done with those expenses, it’s time to think of how much money you’ve set aside for the “life happens” expense.

We’re talking about money for unexpected expenses like flat tires, medical copays, replacing broken items, or other unexpected costs.

Usually, when those kind of events happen, you pull money from your emergency fund.

We’ll go more into detail about that later.

Maybe right now, after you have all the numbers in front of you, you may be feeling a sense of dread.

Maybe you realized you’re spending way too much money on groceries.

Maybe your rainy day fund is lighter than you expected.

Whatever the case may be, you recognize the gaps.

You think you can afford to cut back on something so you can feel more secure about your situation.

Now is the time you go to the next part.

Thinking of Alternatives

Before you start cutting things out completely, let’s first see if you can find alternatives to what you have.

In this stage, you’re exploring your other options in getting the bill lower.

And that’s not a bad thing. It doesn’t mean you have to give up everything you enjoy.

Instead, you’re looking for options that cost less but still provide the same—or nearly the same—benefits as what you normally use.

Remember, it doesn’t have to stay like this forever. Once your financial situation improves, you can always return to your previous routines or subscriptions.

For now, it’s about being strategic and making small adjustments that help ease your budget.

So, let’s start by looking at a few things you can tackle right away:

Groceries

Groceries are one of the easiest categories that responsibly broke people use to save money without dramatically changing their lifestyles.

Many store-brand products are just as good as name-brand items but cost less.

Also, prices for the things you use can vary significantly between stores. Some items may be cheaper at a different grocery store or even at wholesale stores.

Here are a few examples of changes I made in my own grocery shopping:

|

$24.42

|

$7.92

|

|

$13.98

|

$3.43

|

|

$6.99

|

$11.99

|

Subscriptions

If you have subscriptions like Spotify, Hulu, or streaming services, it can be tough to let them go completely. Instead, try these approaches:

- Evaluate what you actually use: Which subscriptions are worth keeping?

- Downgrade your plan: Many services have multiple tiers, and switching to a cheaper plan can save you money without cutting you off entirely.

- Pause or cancel temporarily: Some subscriptions let you pause your account, so you can come back later when your budget allows.

This should be relatively easy since you only need to login to your account, see the available plans, and then downgrade to a more affordable option.

Gym Memberships

No one is asking you to not take care of yourself anymore, but you should look into alternatives if the gym memberships are taking too much out of you financially.

Instead of going to a gym for close to $50 or $160 a month, you can join a lower cost gym like Planet Fitness for $10 a month instead. If that doesn’t work for you, you can try working out at home or in a park.

You can one time buy equipment that you need if you have the space for it. You can invest in items like a yoga mat, dumbbells, or resistance bands.

As a responsibly broke person with a limited space, here are a few things I suggest:

|

$59.29

|

$26.10

|

$22.07

|

If you just need a start in working out from home, you can look at resources like Youtube and put on a workout video like Blogilates or Grow With Anna.

If working out alone in your home sounds boring, you can just dance like no one is watching to music or play workout games like the following:

|

$99.88

|

$55.97

|

$29.83

|

$49.94

|

|

|

|

The key is to find something you enjoy, so it doesn’t feel like a chore.

I’m pretty sure there are more alternative things you can explore like insurance and phone plans, but I’ll let you explore that on your own.

You got the hint that you can do some swaps. Now you’re ready for the next part.

Think of What Can Be Reused

You just explored some of the alternative options you could do to not change your lifestyle too drastically.

Now, in this part, be honest with yourself and ask yourself: Do I already have something that can do the job?

Before spending money, take inventory of what’s already in your space. Most homes are filled with underused items that still have plenty of life left in them.

For example, old clothes you no longer wear don’t have to be tossed aside.

T-shirts can become cleaning or dusting rags. Worn-out socks can be used for polishing shoes or wiping down surfaces. Hoodies or sweatpants that aren’t “outside clothes” anymore can still serve as comfortable home wear.

Small storage and organization needs are another easy win.

Instead of buying new organizers, reuse what you already have. Old makeup bags, pencil cases, or pouches can become travel kits, cable organizers, or emergency bags you keep in your car. Glass jars and takeout containers can be repurposed for pantry storage, leftovers, or small household items.

The whole purpose of repurposing items around your home is to stretch what you already own before adding more. Every item you reuse is money you didn’t have to spend again.

Living responsibly broke is about maximizing value, not deprivation or constant sacrifice. When you stop buying duplicates of things you already own, your budget naturally starts to breathe.

Since you have assessed what you can do with the items in your home, next comes the fun part.

See Where You Can Cut Costs

Cutting costs doesn’t mean cutting joy—it means cutting waste.

Take a close look at subscriptions you barely use, recurring charges you’ve forgotten about, or habits that quietly drain money without adding much value to your life anymore.

You don’t need to cut everything. Focus on what doesn’t align with your priorities anymore and make intentional changes from there.

And if there are certain things you’re not quite ready to give up, that’s okay. Instead of forcing yourself to cut them out completely, consider investing in alternatives that help those items last longer or cost less over time.

A good example of this for me is toilet paper.

I wasn’t really happy when I changed from my premium toilet paper to generic brand toilet paper. Honestly, I could tell the difference immediately. The quality just wasn’t good to me and it wasn’t something that I was REALLY okay with in sticking to for the long run.

Since toilet paper was one of those non-negotiables for me, I decided to invest in a bidet instead.

I bought this during the height of the great sickness when everyone was stuck at home and essentials like toilet paper, hand sanitizer, and disinfectants were hard to come by.

It was something I always wanted to try and it was a practical purchase.

Looking back, it was one of the best purchases I’ve ever made.

Even today, it’s continues to help me save money. It significantly slowed down how often I needed to buy toilet paper and has left me feeling cleaner without needing to use as much of the toilet paper as possible. At one point, it actually felt strange whenever I couldn’t use a bidet while traveling—which eventually led me to buy a portable bidet that I can easily keep in my purse or backpack when I’m on the go.

No Batteries Needed - Simply fill with Cool or Warm water and easy to squeeze bidet bottles, You will get a new refreshing experience. and also save wads of toilet papers

Toxin-free and eco-friendly experience Long-reach nozzle that lets you effortlessly control the direction

The design of this bottle lets you use it to treat hemorrhoids, clean during menstruation and help perineal recovery

The large capacity, you have all the water you need for a full single use.You can do soothing cleaning anywhere

After-sales guarantee: if you have any problems with the products, please contact us at any time through amazon, and we will have customer service staff to help you in 24 hours

Another thing I invested that helped me cut down on ongoing costs was reusable paper towels.

PREMIUM MATERIAL: Made from 2-ply organic cotton with waffle weave that's tough on messes and cotton flannel that's gentle enough for your skin! With superior absorbency and durability, it's designed to replace disposable paper towels.

CONVENIENT SIZE: Each towel measures 11 x 13 inches, large enough for kitchen counters, spills, and everyday cleaning tasks.

SNAP FEATURE: Innovative snap design allows towels to connect into a continuous roll for easy storage and dispensing. Made with high-quality stainless steel

WASHABLE DESIGN: Machine washable and reusable, these towels maintain their effectiveness through multiple laundry cycles.

SET INCLUDES: Package contains 10 natural white cotton towels that can be used as dish cloths, cleaning rags, or napkins.

I was already willing to go from name brand paper towels to generic brand, but I still felt like I was spending too much on them. Adding reusable paper towels alongside my generic brand paper towels allowed me to clean up more messes with fewer sheets overall.

I love using these with heavy messes. often substitute them for sponges when washing dishes or cleaning my shower. While they do stain over time from tougher messes, they’re still incredibly useful.

Another major shift I made was cutting out single-use notebooks and planners.

As a college student and educator, I realized I was constantly going through paper, notebooks, folders, and planners—only to use them for a limited time before throwing them away.

It became frustrating to repeatedly rebuy items that served the same purpose over and over again. That’s when I decided to make the switch to using Rocketbook products and erasable pens.

|

$38.99

|

$39.99

|

$13.91

|

I have talked about these products before on a previous post, but they’re worth bringing up again.

They’re perfect if you want a one-and-done solution for notebooks and planners. All you have to do is write on them with eraseable pens, scan the pages with the Rocketbook app to save your notes digitally, and wipe the pages clean with a damp towel or paper towel.

I’ve been using Rocketbook since around 2017, and I’ve never felt the need to try another notebook brand. They helped me get through undergrad and are still helping me today. The only thing I’ve had to consistently repurchase are the Pilot FriXion pens—which is a small trade-off compared to constantly buying new notebooks and planners.

These kinds of changes have helped me financially in the long run.

So if you’re not fully ready to bend on cutting certain things out of your life, take a step back and see if there are investments you can make now that will lower your costs over time.

Being responsibly broke isn’t about denying yourself—it’s about making smarter choices that support both your budget and your comfort.

Build Your Emergency Fund

This is one of the biggest things that separates simply being broke from being one bad situation away from being poor.

An emergency fund is your buffer. It’s what protects you when life does what it always does…throws surprises your way.

Unexpected expenses, a sudden job change, car repairs, medical bills… these things don’t wait until you’re “ready.” Without some savings set aside, moments like these can quickly turn into debt and long-term stress.

You’ll often hear that you should aim to save three to six months of expenses in your emergency fund.

That can sound overwhelming, especially when you’re just trying to get by.

And honestly, most people aren’t there yet. Only 46 percent of U.S. adults have enough to cover three months of expenses, while 24 percent have no emergency savings at all.1

So if you’re not there yet, you’re not behind—you’re normal.

The key is to start small. Even a few hundred dollars can make a real difference. It might cover a car repair, a copay, or a sudden bill without you needing to pull out a credit card.

The goal is security—room to breathe. Not perfection.

To help your savings grow a little faster, consider keeping your emergency fund in a High-Yield Savings Account (HYSA).

These accounts typically offer a higher annual percentage yield (APY) than a regular savings account, which means your money earns more interest just by sitting there.

You’re not trying to get rich off interest. You’re just letting your money work a bit harder for you while it waits for the day you need your rainy day fund.

Building an emergency fund isn’t going to be flashy or sexy, but it’s one of the most responsible moves you can make when you’re broke.

It gives you options. It gives you peace of mind. And it sets the foundation for everything else you’re about to do next.

Grind

You’ve already done the hard, responsible work.

You went through your expenditures and came up with a budget.

You went through your expenses and built a budget.

You looked honestly at where your money was going, found alternatives, invested in things that would lower your costs over time, and even made the tough calls about what to cut out completely.

And yet, after all that effort, you might have come to an uncomfortable realization:

there’s only so much you can cut.

At a certain point, your expenses can’t realistically go any lower, and your savings can’t grow any faster without something else changing. This is a common moment for people trying to live responsibly broke. You’ve tightened the ship, but the numbers STILL feel tight.

That’s when it becomes clear that sometimes the solution isn’t just spending less—it’s earning more.

This is where the grind comes in. Not the “burn yourself out” kind of grind, but the intentional kind that fits the responsibly broke mindset. The kind where you expand your options instead of shrinking your life.

That could look like picking up extra hours at work, learning a new skill that increases your value, starting a small side hustle, or investing time and energy into something that pays off long-term.

None of it has to be perfect or permanent. It just has to move you forward.

Grinding isn’t about suffering for the sake of suffering. It’s about creating choices. Choices that lead to more security, less stress, and eventually, more freedom in how you live your life.

Yes, this phase can feel uncomfortable. It might mean saying no to free time, pushing yourself outside your comfort zone, or doing things you didn’t originally plan on doing.

But it’s also temporary—and it has the potential to completely change your financial trajectory.

You’re not grinding forever. You’re grinding so that one day, you don’t have to.

Upgrade Only What Matters

After sometime on you money journey, you’ll come to the point where things feel a little easier. Your bills are covered, your savings are growing, and you finally have some breathing room.

That’s a great place to be.

But just because you can spend more doesn’t mean everything deserves an upgrade.

This is where many people undo their progress—not because they’re irresponsible, but because upgrades start to feel automatic.

New phone, better clothes, more subscriptions. One small upgrade turns into several, and suddenly the extra money you worked so hard for is gone.

Instead, be intentional.

Spend more on the things that genuinely improve your quality of life or help you make more money or give you more of your time back.

That might mean investing in reliable transportation, better tools for your job, higher-quality essentials you use every day, or education that increases your earning potential.

At the same time, spend less on things that exist mostly to impress others.

Trends fade. Appearances change.

But you’re the one paying the bill—so your money should go toward things that actually make you happier or more secure, not things meant to earn approval.

Being responsibly broke doesn’t mean denying yourself comfort. It means choosing comfort with purpose.

It means upgrading slowly, thoughtfully, and in a way that aligns with what you value—not what social pressure tells you you should want.

When your spending reflects your values instead of expectations, progress stops feeling fragile and starts feeling sustainable.

Being responsibly broke isn’t about struggle. It’s about strategy.

It’s choosing stability over impulse, progress over appearances, and long-term peace over short-term pleasure.

You may not be able to afford everything you want right now—and that’s okay. What matters is that you’re building a life where money no longer controls you.

Living responsibly broke means you’re no longer on autopilot.

You’re not chasing trends, keeping up appearances, or pretending things are fine when they’re not.

You’re paying attention, adjusting as needed, and making decisions that support your future…even when they’re uncomfortable.

This phase isn’t permanent. You’re setting up a foundation.

Every budget you stick to, every smart swap you make, every intentional upgrade you delay is part of building something more stable and sustainable. Progress doesn’t have to be flashy to be real.

If you chose to be responsibly broke on purpose, you’re already ahead.

- https://www.remitly.com/blog/finance/us-emergency-savings-statistics/#:~:text=4%5D%20%5B5%5D-,The%20average%20American%20emergency%20savings%20fund%20is%20around%20$16%2C800,than%20three%20months%20of%20bills. ↩︎

![JUST DANCE 2026 EDITION - Nintendo Switch [Digital Code]](https://m.media-amazon.com/images/I/414DtsiD6VL._SL500_.jpg)

![Nintendo Switch Sports Standard - Nintendo Switch [Digital Code]](https://m.media-amazon.com/images/I/513dxGiaPIL._SL500_.jpg)